Case Results

Initial Opinion of Value: $180,352

Settlement: $3,200,000

Comments: Settlement included additional concessions from pipeline company.

This case involved the partial taking of a permanent easement for a gas transmission pipeline through limestone quarry reserves to a cement manufacturing plant. The valuation of the reserves together with operation impacts were vigorously contested. The resulting judgment after mediation recognized a significant valuation component for the impacts to the property and business operations and included extensive modifications to the terms of the easement.

Initial Opinion of Value: $70,000

Settlement: $1,150,000

Comments: Settlement included additional concessions from pipeline company.

This case involved the partial taking of a permanent easement for a gas transmission pipeline through a heavy industrial property in the process of development. The imposition of the pipeline required extensive modification to the site plans, re-engineering, and wetland mitigation.

FDOT’s Initial Opinion of Value: $194,500

Jury Verdict: $765,635

Comments: The testimony of the property owner was a value of $765,635.

This eminent domain case involved a whole taking, or the acquisition of the landowner's entire property. The primary issue in the case rested on the reasonable probability of rezoning. Florida law and appraisal practice recognize that the value of a parcel of land is a function of the legal uses to which it can be put. The appraiser must consider those reasonably probable uses that can be allowed in the foreseeable future. In this case, the FDOT took the position that the property's use was residential while the owner’s position was commercial. After a five-day trial, the 12-person jury returned a verdict within an hour equaling the owner's opinion of the value of the property.

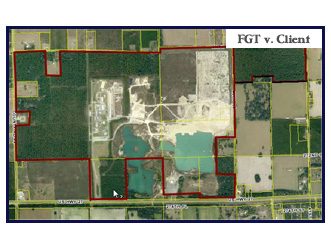

Initial Offer: $816,500

Settlement after Trial: $2,632,983

This partial takings case involved a variety of contested legal and valuation issues. The case was tried before a 12-person jury. One issue in particular centered around the feasibility of mitigating wetland impacts. The market recognizes that wetlands can have a significant contributory value if the costs of mitigation are less than the “as mitigated” value.